Pessimism of the Intellect, Optimism of the Will Favorite posts | Manifold podcast | Twitter: @hsu_steve

Thursday, June 28, 2012

Whither higher education?

Learning or Credentialing? Signaling or Sorting?

Some comments:

1. Internet technology can enhance learning. However, I think the largest impact will be on cognitively gifted or very motivated individuals who will be able to accelerate their education (see, e.g., Khan Academy). For average students, the main barriers to learning have to do with self-motivation and I am not sure that streaming video of lectures, or even a virtual classroom environment which allows rich interaction, will provide better stimulus than the traditional lecture. It seems to me that my intro students have trouble paying attention even when I am literally dancing around at the front of the class, telling jokes and working through elaborate physics demonstrations (which often include explosions or bouncing balls or colorful animations). Moving the lectures online will be cheaper, but not necessarily better -- a win for efficiency, perhaps, but no solution for the difficulty that the average individual has in mastering challenging material.

Ask yourself what the ideal learning environment would be for your child if cost were no object. I think it might be the Oxbridge tutorial system, where a real expert devotes their full attention to training a small number of students (perhaps even a single individual) in great depth. Almost as good would be training in an environment where the student to faculty ratio is low, and the faculty are very focused on pedagogy. Interactions with peers of similar (or superior) ability are as important as those with the tutor/instructor. This ideal limit is quite far from the online systems currently envisaged. Is America too poor to provide this old-fashioned but superior education to (say) the top 10 percent of students? I doubt it.

At the highest quality levels, educational productivity has increased little in the last 100 years. We might improve things around the edges by, say, having lectures from the top scholars available online, along with tools enabling students from different universities to exchange ideas and answer each other's questions. But I don't think we'll see substantive productivity improvement here until we -- gulp -- solve the AI problem and create robot genius professors. Only a small number of students could crowd around Feynman at Caltech's Physics X to hear him explain the EPR paradox. I don't expect that to change anytime soon. (You can record Feynman's comments about EPR; you can't allow thousands of students around the world to interact with him one on one.)

2. Credentialing is complex and even the system we have had in place for several generations is not well understood either by students or by employers. What are the key factors that employers need to determine about an applicant? Intelligence (reasonably well measured by simple tests; but even this is not widely acknowledged in broader society), Conscientiousness (difficult to measure without actually putting someone through a challenging program over a period of years), Ambition/Drive (similar to Conscientiousness), and finally: Creativity, Adaptability and Interpersonal Skills -- all extremely difficult to measure.

I am not sure that Internet technologies will really improve our Credentialing capabilities. We already have testing centers, GRE subject exams, Actuarial exams, narrow skill certifications like Microsoft MCSE, etc. It's more a matter of cultural attitudes than anything else -- when will employers start accepting a high SAT score and some narrow skill certification in place of, say, an engineering degree from a well-known university? Has anyone done systematic research on the relative validities (predictive power) of different kinds of certification for a wide variety of employment settings? I only know of results for general cognitive ability (g).

Plenty of room at the top

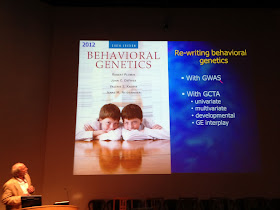

In the context of human genetics, it's clear there's plenty of room at the top -- possibly as much as +30 SDs based on existing variance in the human population! (Compare to the result of selection in maize.) This is the last slide from my BGA 2012 talk:

At some point I may be able to post the audio, as all the talks were recorded. The slides may be a bit hard to understand on their own.

Finance and the allocation of human capital

See also my earlier post A reallocation of human capital (pre-financial crisis).... a bloated financial sector can also suck in more than its share of talent, hampering the development of other sectors.8That last sentence is a smack in the face, isn’t it? FT Alphaville was dying to know what Footnote 8 would contain.Here it is:8 See S Cecchetti and E Kharroubi, “Reassessing the impact of finance on growth”, BIS, January 2012, mimeoSo we looked it up. From the introduction:… in our examination of industry-level data, we find that industries that are in competition for resources with finance are particularly damaged by financial booms. Specifically, we show that manufacturing sectors that are either R&D-intensive or dependent on external finance suffer disproportionate reductions in productivity growth when finance booms.At first, these results may seem surprising. After all, a more developed financial system is supposed to reduce transaction costs, raising investment directly, as well as improve the distribution of capital and risk across the economy. 1 These two channels, through the level and composition of investment, are the mechanisms by which financial development improves growth. 2 But the financial industry competes for resources with the rest of the economy. It requires not only physical capital, in the form of buildings, computers and the like, but highly skilled workers as well. Finance literally bids rocket scientists away from the satellite industry. The result is that erstwhile scientists, people who in another age dreamt of curing cancer or flying to Mars, today dream of becoming hedge fund managers.

Friday, June 22, 2012

Edinburgh 2

A portrait of Peter Higgs:

The opening reception for BGA 2012:

BGA talks at the Royal College of Physicians:

Archival interview with twins research pioneer Tom Bouchard:

Robert Plomin on twins and modern SNP-based heritability:

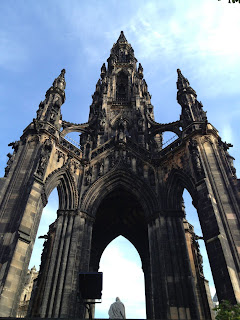

My last evening in beautiful Edinburgh:

Thursday, June 21, 2012

Financial Weaponry

I posted some excerpts earlier here.

Tuesday, June 19, 2012

Monday, June 18, 2012

Intellectual tourism

What could be more fun than exploring a new world? :-)

Thursday, June 14, 2012

Tuesday, June 12, 2012

What were they discussing?

Some Ulam quotes from his autobiography Adventures of a Mathematician.

One of the luckiest accidents of my life happened the day G. D. Birkhoff came to tea at von Neumann's house while I was visiting there. We talked and, after some discussion of mathematical problems, he turned to me and said, “There is an organization at Harvard called the Society of Fellows. It has a vacancy. There is about one chance in four that if you were interested and applied you might receive this appointment."I came to the Society of Fellows during its first few years of existence ... I was given a two-room suite in Adams House, next door to another new fellow in mathematics by the name of John Oxtoby ... He was interested in some of the same mathematics I was: in set theoretical topology, analysis, and real function theory.

... While l was at Harvard, Johnny came to see me a few times and I invited him to dinner at the Society of Fellows. We would also take automobile drives and trips together during which we discussed everything from mathematics to literature and talked without interruption while still paying attention to our surroundings. Johnny liked this kind of travel very much.

... Edward [Teller] took up my suggestions, hesitantly at first, but enthusiastically after a few hours. ... Teller lost no time in presenting these ideas ... at a ... meeting in Princeton which was to become quite famous because it marked the turning point in the development of the H-bomb.

... It seems to me this was the tragedy of Oppenheimer. He was more intelligent, receptive, and brilliantly critical than deeply original. ... Perhaps he exaggerated his role when he saw himself as the "Prince of Darkness, the destroyer of Universes." Johnny used to say, "Some people profess guilt to claim credit for the sin."

... Banach once told me, "Good mathematicians see analogies between theorems or theories, the very best ones see analogies between analogies." Gamow possessed this ability to see analogies between models for physical theories to an almost uncanny degree ... It was along the great lines of the foundations of physics in cosmology and in the recent discoveries in molecular biology that his ideas played an important role. His pioneering work in explaining the radioactive decay of atoms was followed by his theory of the explosive beginning of the universe, the “big bang" theory (he disliked the term by the way) and the subsequent formation of galaxies.

University of Edinburgh: Introduction to Technology Startups

Mmmm... doughnuts!

Roberts Funded LectureIntroduction to technology startups

Steve Hsu

Professor of Theoretical Physics & Director, Institute for Theoretical Science

University of Oregon

Wednesday 20 June 2012 from 1600

All welcome!

In the past, applied research and development was concentrated at corporate labs like Bell, IBM, Xerox PARC, etc. Today, innovation is more likely to be found at small venture capital backed companies founded by creative risk takers. The odds have never been greater that you, a scientist or engineer, might someday work at (or found!) a startup company. The talk is an introduction to this important and dynamic part of our economy, from the perspective of a physics professor and serial entrepreneur.

Lecture Theatre C, School of Physics & Astronomy, James Clerk Maxwell Building, Kings Buildings

Doughnuts and coffee at 1600

Talk 1630-1730

Sunday, June 10, 2012

ICQG and BGA 2012

The title of my talk is Some results on the genetic architecture of human intelligence. I will post my slides on the blog at some point. For now, here are a few (click for larger versions).

Wednesday, June 06, 2012

Pricing the Future

Financial Weaponry

Almost every physicist or mathematician below a certain age knows a former colleague or classmate who now works in finance. Older scientists, however, can probably remember a time before such “quants” existed. What happened to create this new and lucrative profession over the course of a few decades?

... Since the payoff depends on future events, any pricing model must include, at minimum, a probability distribution over future outcomes. But in fact the problem is more subtle, because the value of a given probability distribution of future payouts to a particular individual depends on that individual’s attitude towards risk. ...

... but experts are violently divided on the more general societal utility of advances in derivatives theory and practice. The conventional view, taught in business schools and in economics departments, is that financial innovation enables economic dynamism and allows markets to allocate resources more efficiently. The opposing perspective, held by none other than billionaire investor Warren Buffett, is that derivatives are "financial weapons of mass destruction" -- speculative instruments in a complex global casino that carry more risk than benefit. When Buffett’s company, Berkshire Hathaway, bought the reinsurance firm General Re in 1998, the latter had 23,000 derivative contracts. Buffett later explained his attitude towards these contracts to a US government panel: “I could have hired 15 of the smartest people, you know, math majors, PhDs. I could have given them carte blanche to devise any reporting system that would enable me to get my mind around what exposure that I had, and it wouldn’t have worked,” he said. “Can you imagine 23,000 contracts with 900 institutions all over the world, with probably 200 of them names I can’t pronounce?” Ultimately, Buffett decided to unwind the derivative deals, even though doing so incurred some $400 million in losses for Berkshire.

The recent financial crises suggest that Buffett’s attitude may be the right one, and that the potential benefits of derivatives and other complex instruments come with dangerous systemic risks. At a recent meeting to address post-crisis financial reforms, the former chief of the US Federal Reserve, Paul Volcker, commented: “I wish somebody would give me some shred of evidence linking financial innovation with a benefit to the economy.” In Pricing the Future, Szpiro gives us a colourful history of derivatives, but does little to address Volcker’s fundamental question.

Monday, June 04, 2012

Look up, not down!

NYTimes: The phone call came like a bolt out of the blue, so to speak, in January 2011. On the other end of the line was someone from the National Reconnaissance Office, which operates the nation’s fleet of spy satellites. They had some spare, unused “hardware” to get rid of. Was NASA interested?

... Sitting in a clean room in upstate New York were a pair of telescopes the same size as the famed Hubble Space Telescope, but which had been built to point down at the Earth, instead of up at the heavens.

... to turn one of the telescopes loose on the cosmos, pointing in its rightful direction, outward, to investigate the mysterious dark energy that is speeding up the expansion of the universe. If the plan succeeds — and Congress, the Office of Management and Budget and the Academy of Sciences have yet to sign on — it could shave hundreds of millions of dollars and several years off a quest that many scientists say is the most fundamental of our time and that NASA had said it could not undertake until 2024 at the earliest.

Sunday, June 03, 2012

12.87 110H in Eugene

Liu Xiang tied the world record at 12.87, but it was ruled wind-aided at +2.4m/s. This field was world class, only missing current world record holder Dayron Robles of Cuba. David Oliver, the US record holder, was a WR at Howard and is huge for a hurdler at around 200 lbs. Ashton Eaton, in lane 1, is a top decathlete who competed at U Oregon as a collegian. My kids got to play dodgeball with him a few years ago :-)

At the end of his victory lap Liu ends up among women competitors preparing for the start of the 3000m. He looks gigantic in comparison.

I often run at Hayward Field, but not as fast :-(

Saturday, June 02, 2012

Culture, Communism, and China's Modern Consumer

ChinaSmack: ... After 13 years here, I am fundamentally convinced that there is a unifying “Confucian” conflict — between self-protection and status projection — that brands have a fundamental role in resolving. Unlike practically any other country (Korea and Vietnam come closest), China is both boldly ambitious (ladders are meant to be climbed and meritocracy is a cherished value) and regimented, with hierarchical and procedural booby traps for anyone who hasn’t mastered the “system.” This tension between upward mobility and fear-based conformism shows up everywhere, in every business meeting, in every struggle with a mother-in-law, in every new generation release on the internet.